The Essential Guide to Understanding Estate Administration

In today’s society, estate administration has become a critical aspect of personal and financial planning. It involves managing and distributing a person’s assets, including property, possessions, and investments after their death. It is a complex and often emotional process that can be daunting for those who are not familiar with it. That’s where this essential guide comes in. Whether you are a loved one of the deceased, an executor of their will, or simply want to have a better understanding of the topic, this article will provide you with everything you need to know about estate administration. From the basics to the details, we’ve got you covered.

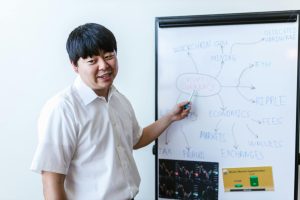

What is Estate Administration?

Before we dive into the details, let’s first define what estate administration is. As mentioned, it is the process of managing and distributing a person’s assets after their death. This includes paying off any debts and taxes owed by the deceased, gathering and valuing their assets, and distributing them according to their will or state laws if there is no will. It is also known as probate, which is the legal process of validating a will and carrying out its instructions.

The Importance of Understanding Estate Administration

Now, you may be wondering, why is it essential to understand estate administration? First and foremost, it can help you prepare for the future and ensure that your wishes are followed after you pass away. It can also help ease the burden on your loved ones during an already difficult time. For those who are not directly involved in estate administration, having a basic understanding of it can also be beneficial in dealing with estate planning and legal matters.

Key Players in Estate Administration

There are several people and entities involved in estate administration. These include the deceased’s family members, executors, attorneys, and the court system. Let’s take a closer look at each of these key players:

Family Members

The deceased’s family members, also known as beneficiaries, are those who stand to inherit from the estate. They may be spouses, children, parents, or other relatives depending on the deceased’s familial situation and the terms of their will. These individuals are often emotionally and financially impacted by the outcome of estate administration.

Executor

The executor is responsible for managing the estate administration process. They are named in the deceased’s will and carry out the instructions outlined in the document. The executor must gather and value assets, pay any debts and taxes, and distribute the remaining assets to the beneficiaries. It is essential to choose an executor who is trustworthy, organized, and able to handle the responsibilities involved.

Attorneys

Attorneys play a crucial role in estate administration. They can help with drafting a will, provide legal advice, and oversee the probate process. They can also assist with potential legal issues that may arise during estate administration, such as disputes between beneficiaries or challenges to the will’s validity.

Court System

Finally, the court system is involved in estate administration to ensure that the process is carried out according to state laws and regulations. If there is no will or no executor named, the court will appoint an administrator to handle the estate administration process.

The Probate Process

As mentioned earlier, probate is the legal process of validating a will and carrying out its instructions. The probate process varies depending on the state’s laws, but generally follows these steps:

Filing and Notification

The first step is to file the will with the court in the county where the deceased resided. The executor must also notify all beneficiaries and potential heirs of the deceased’s passing and the probate process.

Gathering and Valuing Assets

The executor must gather and identify all assets owned by the deceased, including real estate, bank accounts, investments, and personal property. They must also determine the value of these assets at the time of the deceased’s passing.

Paying Debts and Taxes

Before any assets can be distributed, the executor must settle any outstanding debts and taxes owed by the deceased’s estate. This includes funeral expenses, outstanding bills, and estate taxes.

Distributing Assets

Once all debts and taxes have been settled, the remaining assets can be distributed to the beneficiaries according to the will’s instructions. If there is no will, state laws will dictate how the assets are distributed.

Avoiding Probate

Many people want to avoid the probate process because it can be lengthy and incur additional expenses. There are several ways to do this, such as creating a living trust, which allows assets to be transferred to a trustee during the deceased’s lifetime, thereby bypassing probate. Other methods include joint ownership, beneficiary designations, and gifting assets during one’s lifetime. It is important to note that avoiding probate may not always be the best option, so it is essential to speak with an attorney before making any decisions.

Final Thoughts

Estate administration may seem overwhelming, but with the right knowledge and guidance, it can be a smooth and manageable process. Understanding the basics of estate administration, the key players involved, and the probate process can help you prepare for the future and ensure your loved ones are taken care of after you pass away. If you find yourself in the midst of estate administration, consulting with an experienced attorney can provide valuable support and guidance through the process. With this essential guide, you are now equipped with the necessary information to navigate estate administration effectively.