The Hidden Costs of Carrying High-Interest Credit Card Debt

Have you ever lost sleep worrying about debt? If you’re like many Americans, credit card debt may be a major source of your financial stress. According to a survey by the National Foundation for Credit Counseling, over 1 in 4 Americans carry credit card debt from month to month. And with interest rates reaching as high as 30%, it’s no surprise that this type of debt can quickly become overwhelming. But beyond the obvious financial strain, there are hidden costs of carrying high-interest credit card debt that many people are not aware of. In this article, we’ll explore these hidden costs and how they can impact your financial well-being.

The Cost of Interest Rates

The most obvious cost of carrying high-interest credit card debt is the interest rate itself. When you carry a balance on your credit card, the lender charges you a certain percentage of the balance as interest every month. This means that the longer you carry a balance, the more interest you will owe. And with credit card interest rates ranging from 12% to 30%, this can quickly add up. For example, if you have a credit card balance of $5,000 with an interest rate of 20%, you will be charged $1,000 in interest every year. That’s $1,000 that could have gone towards paying off the debt instead.

The Impact on Your Credit Score

Aside from the financial hit, carrying high-interest credit card debt can also have a negative impact on your credit score. Your credit utilization ratio, which is the amount of credit you’re currently using compared to your total available credit, is a major factor in determining your credit score. The higher your credit utilization ratio, the lower your credit score will be. So if a large portion of your credit card limit is being used, it could significantly lower your credit score and make it harder for you to obtain loans or credit in the future.

Fees and Penalties

Another hidden cost of carrying high-interest credit card debt is the fees and penalties that come with it. Late payment fees, over-limit fees, and cash advance fees are just a few examples of the many fees that credit card companies charge. These fees can easily add up and increase the total amount of debt you owe. If you’re consistently unable to make your payments on time, you may also face penalty interest rates, which are even higher than the standard interest rates. This can make it even more difficult to pay off your debt and dig yourself out of the credit card cycle.

The Cost of Stress

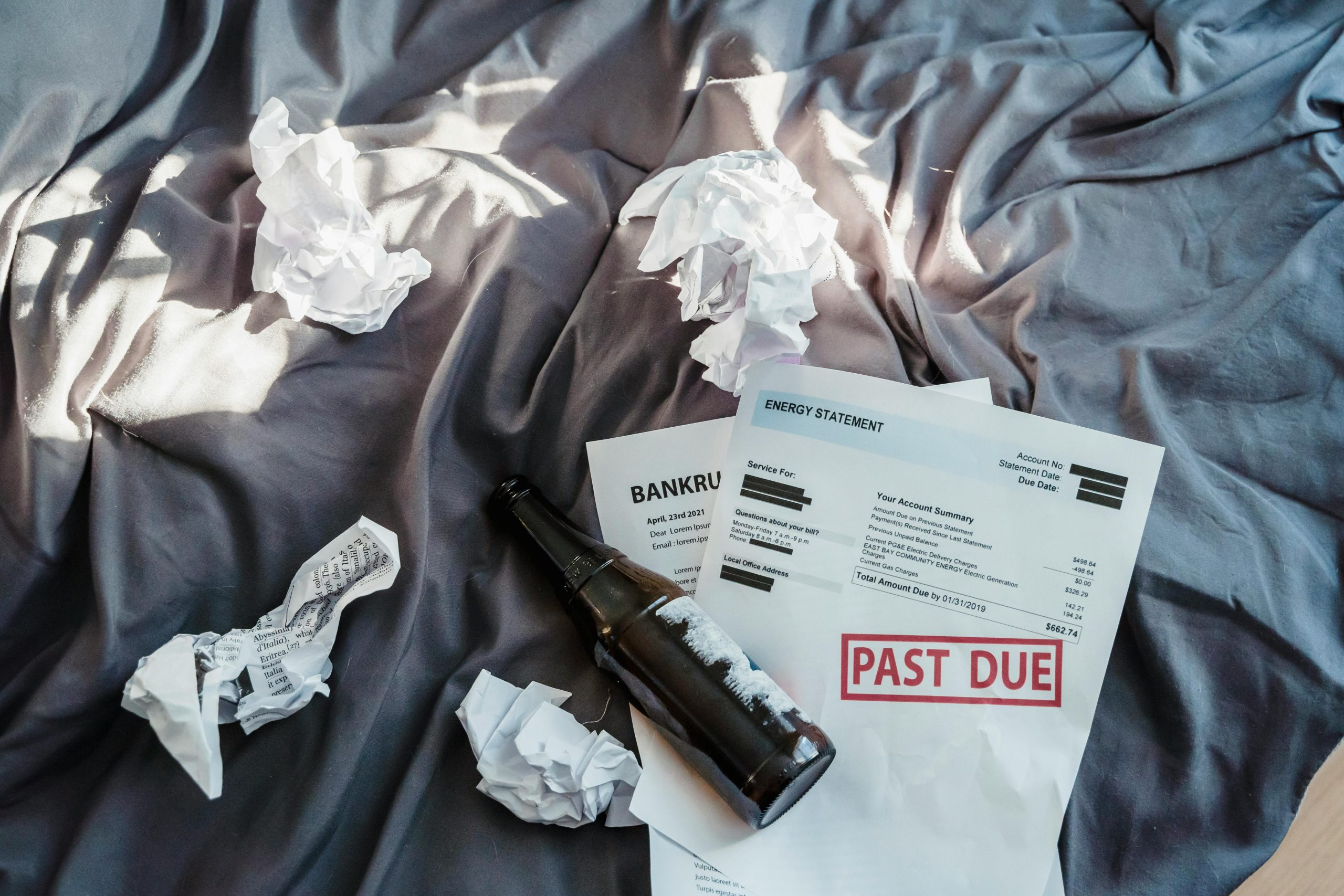

The hidden costs of carrying high-interest credit card debt go beyond just the financial aspect. The stress and anxiety that come with having significant debt can take a toll on your mental and emotional well-being. Constantly worrying about how to make payments and feeling trapped in a cycle of debt can lead to negative effects on your relationships, work performance, and overall happiness. It’s important to consider these hidden costs and take steps to manage your debt in order to alleviate this stress and improve your quality of life.

How to Manage High-Interest Credit Card Debt

Now that we’ve explored the hidden costs of carrying high-interest credit card debt, you may be wondering how to manage and reduce your debt. The first step is to evaluate your spending habits and make a budget that includes paying off your credit card debt. You may also consider transferring your high-interest credit card balances to a card with a lower APR or consolidating your debt into a loan with a lower interest rate. It’s also important to make all of your payments on time to avoid any additional fees or penalties.

Seeking Professional Help

If your debt has become unmanageable and you’re struggling to make even the minimum payments, it may be time to seek help from a credit counselor or a debt settlement company. These professionals can provide you with a personalized plan to help you pay off your debt and manage your finances more effectively.

In Conclusion

Carrying high-interest credit card debt can have significant hidden costs that go beyond the obvious financial burden. From high interest rates and fees to damaging your credit score and causing stress, the impact of this type of debt can be far-reaching. It’s important to be aware of these hidden costs and take steps to manage your debt in order to improve your financial well-being and overall quality of life. Remember, the key to avoiding these hidden costs is to stay informed, make responsible financial decisions, and seek help when needed.